The Many Advantages of Leasing

Equipment leasing is gaining popularity in the turf industry as golf clubs, schools, councils and contractors need to preserve scarce capital and lower their operating costs. Leasing is also extremely flexible enabling a contract to be structured in a variety of ways, for example;

- Staggered payments – low in your off-season and higher during peak cash flow periods

- Maintenance may be built into the monthly lease payments

- Maintenance bonuses where you share in any profits made on sale.

Experience has shown that there is little difference in the long-term cost of owning or leasing equipment when interest is taken to account. But with leasing;

- Maintain cash flow – as no capital is needed up front.

- Less down time – as always using the latest machinery in its most trouble free years.

- Easy to budget – as it is a fixed payment over a finite time period.

- Payments are tax deductible for businesses (This is not applicable for incorporated societies)

- For peace of mind maintenance can be built into monthly lease payments.

With an intimate knowledge of finance and the turf maintenance market, Parkland can structure a tailor-made lease to suit your organisation.

Parkland is the Leasing Expert

An intimate knowledge of finance and equipment markets allows Parkland to structure a lease contract to suit your organisation. A Parkland lease can even include features such as staggered payments (low in your off-season and higher during peak cash flow periods) and excellent maintenance bonuses where you share in any profits made on sale.

Leasing is not only available for new or Red Value equipment. Parkland will also purchase your existing equipment on a lease back basis.

When you’re next buying equipment, Parkland will show you how a lease can be tailor-made for you.

Thinking About Leasing?

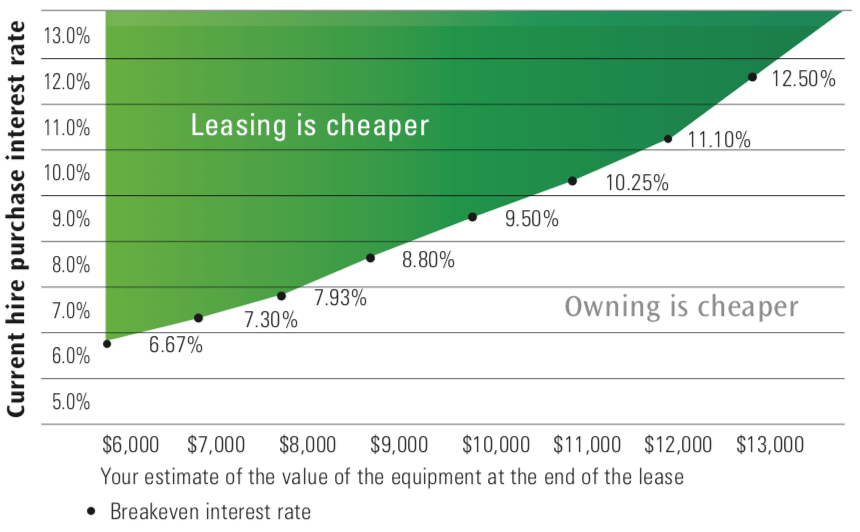

To determine if leasing or owning the equipment is better for you:

- Take the current hire purchase interest rate, and

- Your estimate of the value of the equipment at the end of the lease, and

- Mark this point on the graph.

- If your point is above the breakeven interest rate (in the green shaded area) then leasing is cheaper. If it is below the breakeven interest rate, then owning is cheaper.

Leasing’s great advantage is that a contract can be structured in a variety of ways, to suit a variety of needs.

Here’s How a Parkland Leasing Contract Could Work For You

Monthly Basis

| Toro Reelmaster 3100 Sidewinder | |

|---|---|

| Lease Term | 3 Years |

| Expected Annual Usage | 500 Hours |

| Special Conditions | Right of Renewal for Extra 3 Years |

| Payment Method Selected By You | Fixed Monthly |

| Monthly Cost | $980 + GST |

Hourly Basis

| Toro Groundmaster 7210 Zero Turning Radius Mower | |

|---|---|

| Age of Commencement of Lease | 3 Years |

| Expected Annual Usage | 900 Hours |

| Purchased by you for | $14,000 + GST |

| Lease Term | 2 Years |

| Payment Method Selected By You | Variable on Hours of Use |

| Monthly Cost | 980 + GST |

Main Benefits of Leasing

- No capital is needed up front.

- The capital cost of equipment is not shown on your balance sheet.

- You can lease either Toro or Red Value equipment.

- You can select either a short or long term contract.

- The lease period is fixed.

- Monthly payments are fixed.

- Payments are tax deductible (this is not applicable for incorporated societies – but then depreciation and interest aren’t either).

- Maintenance may be built into monthly lease payments.

- As the supplier, Parkland remains the legal owner of the equipment. At the end of the lease, the equipment is returned to us to sell. Any loss made on the sale is carried by Parkland.

Is Leasing a Better Option?

Experience has shown that there is little difference between the long term cost of owning or leasing mowing and turf renovation equipment. Whether you chose a lump sum capital payment or a regular monthly hire charge, the outlay is similar when interest is taken to account.

Owning equipment may be a better bet for those with a low cost of capital – for example, organisations with cash reserves on long-term bank deposit, at low rates of interest.

The value of equipment at the end of a lease is a significant factor. Parkland can calculate the net present value to provide the answer.